Effective Strategies to Boost Your Credit Score

Introduction

Achieving a good credit score is not just advantageous but essential in today's financial climate. A high credit score can lead to better interest rates, easier loan approvals, and even favorable terms on various financial products. Yet, understanding how to improve your credit score remains a mystery for many. Whether you're striving to repair past damage or simply enhance your current standing, the journey requires dedication and informed steps. Delightfully, boosting your credit score is within your control, provided you adhere to consistent and strategic practices. Let’s explore actionable ways to enhance your credit score effectively.

Advertisement

Understand Your Credit Report

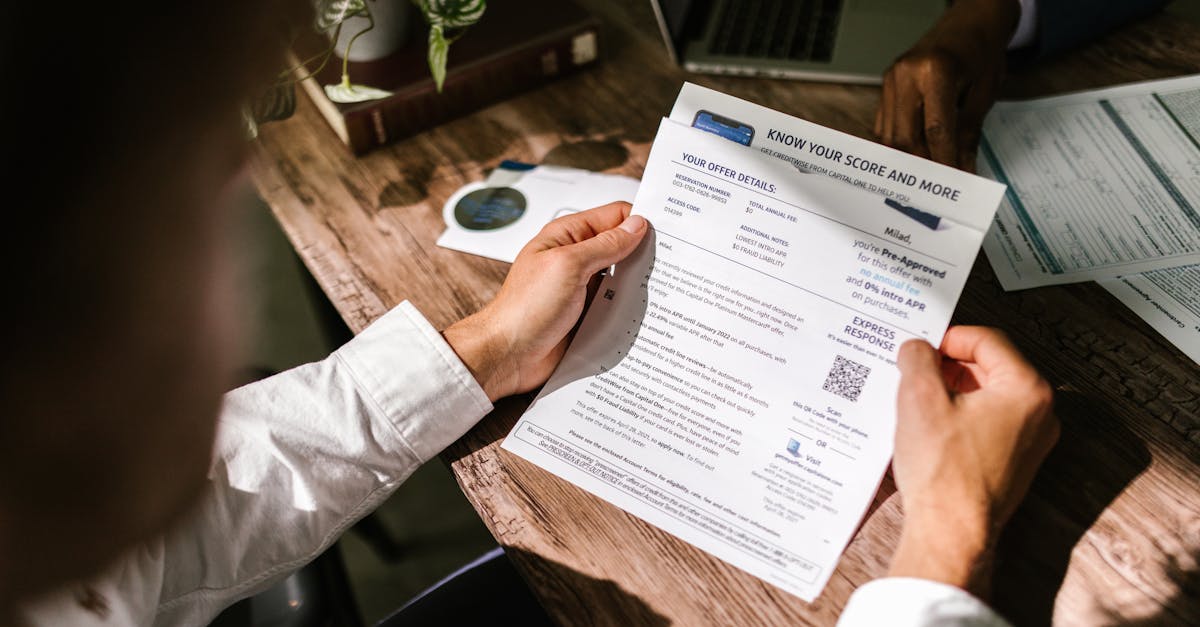

The journey to boosting your credit score begins with understanding your credit report. Obtain your free credit report from reputable agencies like Equifax, Experian, or TransUnion. Scrutinize the details to identify any inaccuracies or anomalies present in your report. Errors, whether clerical or systemic, can negatively impact your credit score. Dispute these inaccuracies promptly with the credit reporting agency. Resolution of these errors might lead to an immediate positive change. Regular monitoring of your credit report ensures you remain informed and proactive.

RDNE Stock project/Pexels

Advertisement

Timely Bill Payments

One of the most crucial factors influencing your credit score is your payment history. Consistent, timely payments exhibit financial responsibility. Late or missed payments, on the other hand, can lead to a dip in your score. Consider setting up automated payments or calendar reminders to ensure you never miss a due date. Even catching up on past-due bills can lead to gradual improvements. Remember, each on-time payment contributes not only to a healthier credit score but also builds financial trustworthiness.

Advertisement

Manage Your Debt Wisely

It’s essential to have a comprehensive understanding of your outstanding debts. Consolidate your debts if possible, and aim to pay more than the minimum requirement each month. Tackling high-interest debts first can potentially save money and time. Reducing your credit card debt to maintain a utilization rate below 30% can significantly enhance your score. Strategically paying off debts continues to demonstrate your financial resilience. A commitment to responsible debt management is key to a stable and improved credit score.

Advertisement

Limit New Credit Applications

While it might be tempting to apply for multiple credit cards or loans, resist doing so in a short span. Each new application results in a hard inquiry, slightly denting your score. It's vital to avoid unnecessary credit sourcing unless absolutely needed. If you're determined to apply for a new line of credit, ensure it's backed with justifiable reasons and research. Strategize when and how often you apply for credit to minimize risk. Remember that patience and timing play pivotal roles in the pursuit to enhance your credit score.

Advertisement

Lengthen Credit History

The length of your credit history plays an essential role in your overall score. Maintaining older credit accounts open can help lengthen this history. Even if inactive, these accounts contribute positively to your average account age. Resist the urge to close old accounts for the sake of decluttering. Instead, consider making small charges to keep them active if needed. A longer, well-managed credit history depicts seasoned financial stability, boosting your overall creditworthiness.

Advertisement

Diversify Your Credit Mix

Lenders prefer seeing a well-managed diversity in your credit accounts. A potential mix could include revolving credit accounts like credit cards and installment loans such as student or auto loans. Continuously managing these diverse credit sources efficiently reflects positively on your profile. However, diversifying for the sake of diversity can be detrimental. Ensure to add credit types that are necessary and manageable to maintain. Responsible management across varied credit types highlights a robust financial understanding.

Advertisement

Seek Professional Help if Needed

If the journey to improving your credit score seems overwhelming, consider seeking guidance from a financial advisor or credit counselor. These professionals can offer tailored insights and strategic approaches to addressing your credit concerns. They can also assist in setting realistic goals aligned with your financial aspirations. Utilizing their expertise can prevent avoidable missteps and enhance your capability to manage credit efficiently. Don’t hesitate to reach out; a little guidance can go a long way.

Advertisement

Develop Financial Literacy

In the grand scheme of building and maintaining credit, developing a deep understanding of financial principles is invaluable. Equip yourself with knowledge about credit scores, financial products, and sound budgeting practices. Engage with reputable online resources, attend workshops, or take courses related to personal finance. This literacy not only aids in making informed decisions but also prepares you for unforeseen circumstances. The more financially literate you are, the more adept you'll become at navigating challenges, thus safeguarding your credit score.

Advertisement

Conclusion

Improving your credit score is a journey that requires time, dedication, and sound financial management. By understanding your credit report, committing to timely payments, and responsibly managing debt, significant improvements can be realized. Furthermore, maintaining an aged credit history in tandem with diverse credit types ensures a robust credit profile. Reinforce this process with continuous financial learning and professional guidance. Ultimately, your credit score is a reflection of your financial discipline and resilience.

Advertisement